|

LISTEN TO THIS THE AFRICANA VOICE ARTICLE NOW

Getting your Trinity Audio player ready...

|

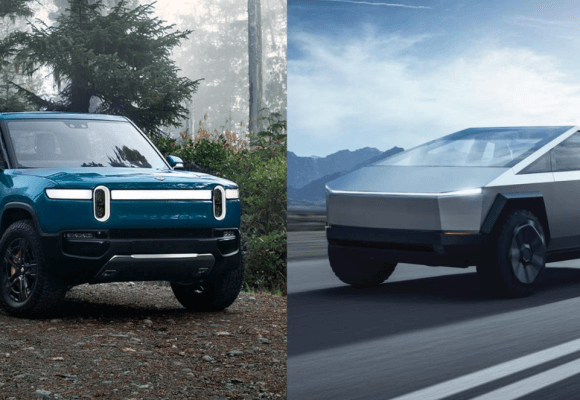

The electric vehicle (EV) revolution is in full swing, with China and the United States at the forefront. However, the two markets differ significantly in scale, competition, and technological advancements. While the US has seen steady growth in EV adoption, China’s market is expanding at a breakneck pace, fueled by strong government support, a vast manufacturing ecosystem, and fierce competition among domestic automakers.

Market Size and Number of EV Models

China is the world’s largest EV market, with over 300 EV models available from more than 94 domestic manufacturers (as of 2024). This includes established players like BYD, NIO, XPeng, and Li Auto and newer entrants such as Huawei-backed Aito and Xiaomi’s recently launched SU7.

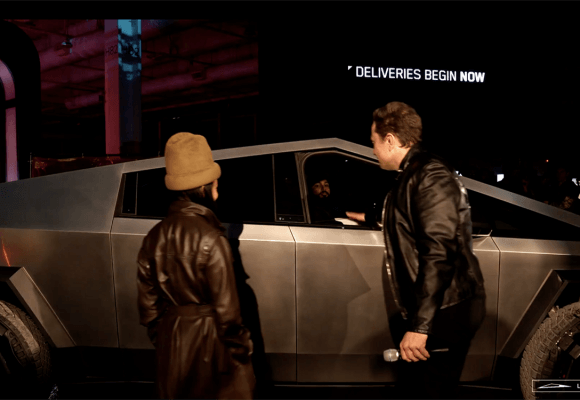

In contrast, the US has far fewer options, with around 50 EV models on the market, primarily from Tesla, Ford, GM, Rivian, and Lucid. Tesla dominates with over 50% market share, while legacy automakers are still ramping up production. Globally, China accounts for nearly 60% of all EV sales, according to the International Energy Agency (IEA).

Battery Technology and Range: China’s Breakthroughs

Battery performance is a key differentiator between the two markets. Chinese manufacturers have made significant strides in energy density and range, with CATL (Contemporary Amperex Technology Co. Limited) leading the way.

- CATL’s new “Qilin” battery boasts a 1,000 km (621-mile) range on a single charge, as reported by Technode. This solid-state-like battery is expected to enter mass production soon, setting a new benchmark for the industry.

- BYD’s Blade Battery, used in models like the Han EV, offers improved safety and a range of up to 715 km (444 miles).

- In the U.S., Tesla’s 4680 battery cells (used in the Cybertruck and Model Y) promise around 400-500 miles of range, while Lucid’s Air Dream Edition achieves 516 miles (830 km)—currently the highest in the US market.

China’s aggressive investment in battery R&D has given it an edge, with CATL supplying nearly 37% of the world’s EV batteries, followed by BYD at 15.7% (2023 data). In contrast, the US relies heavily on partnerships with Korean firms (LG Energy Solution, SK On) and Panasonic.

Future Prospects: Different Paths Forward

China: Expansion and Global Dominance

China’s EV market benefits from:

- Strong government subsidies and infrastructure (over 2.2 million public charging points, vs. ~180,000 in the US).

- Economies of scale—BYD sells more EVs than Tesla in China and is expanding aggressively in Europe and Southeast Asia.

- Battery supply chain control—China refines 80% of the world’s lithium and dominates cathode production.

US: Innovation and Policy Push

The US is playing catch-up, but has strengths:

- Tesla’s software and charging network, including Superchargers, remain a competitive advantage.

- The Inflation Reduction Act (IRA) incentivizes domestic battery production, with companies like GM and Ford investing heavily.

- Emerging solid-state battery startups (QuantumScape, Solid Power) could leapfrog current lithium-ion tech.

Take Away: Collaboration or Competition?

While China leads in market size and battery innovation, the US retains strengths in software, brand power, and high-end EVs. The future may not be a zero-sum game—global supply chains mean advancements in one market benefit the other. However, with China’s rapid scaling and breakthroughs, such as CATL’s nearly 1,000-mile battery, the pressure is on the US to accelerate its EV transition.

The next decade will determine whether the US can close the gap or if China’s first-mover advantage will cement its position as the global EV leader.

LEAVE A COMMENT

You must be logged in to post a comment.