|

LISTEN TO THIS THE AFRICANA VOICE ARTICLE NOW

Getting your Trinity Audio player ready...

|

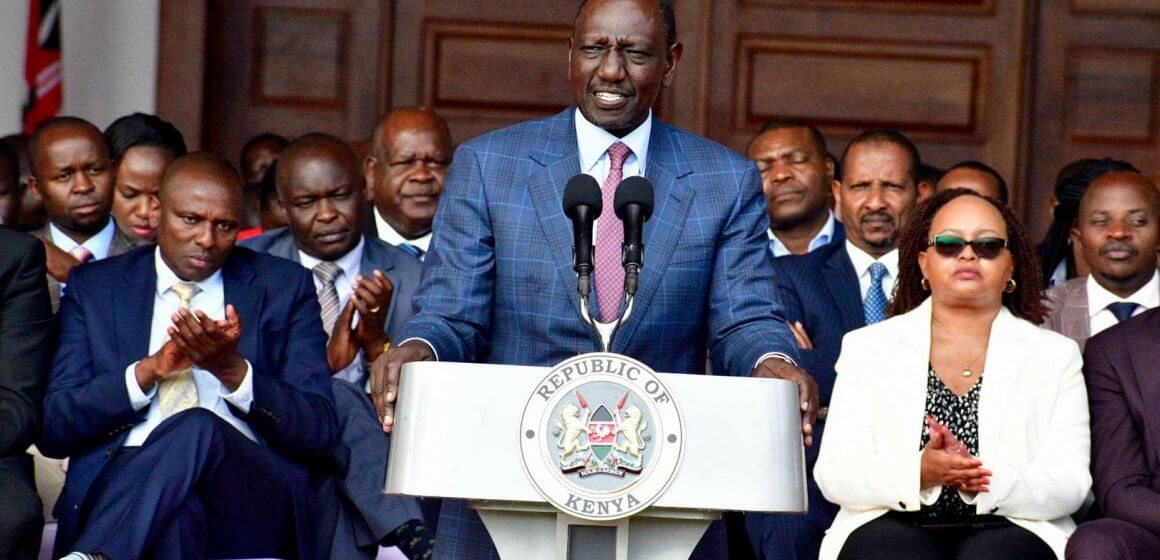

The Parliamentary Budget Office (PBO) Tuesday sounded a cautionary note to President William Ruto’s administration, urging against the imposition of new taxes that could add further pressure on an already strained population without necessarily boosting revenue.

In a detailed report released on Tuesday, titled “Budget Watch for 2024/2025,” the PBO emphasized the need for the government to adopt alternative approaches to address the nation’s growing fiscal challenges.

The recommendation comes at a time when the government is grappling with the consequences of the rejected Finance Bill 2024, a setback that has led to significant cuts in public spending. Due to the stalled bill, the government had to scale back on its budget, including slashing funds allocated to various ministries and halting new development projects. The situation has also forced the administration to rely more heavily on development partners and foreign donors, who now cover a substantial 43% of the development budget.

The PBO—a body responsible for providing fiscal and economic guidance to the Kenyan Parliament—highlighted that introducing new tax measures might not result in higher revenue collections as anticipated. Instead, it pointed out that improving the efficiency of current tax systems could yield better results. The office suggested that technological advancements should be used to close existing loopholes in tax administration, advocating for improved compliance and enhanced monitoring of tax revenue.

The PBO report also highlighted the Treasury’s persistent struggle with revenue collection. In the 2022/2023 financial year, the government faced a revenue shortfall of 123 billion shillings, a gap that widened to 205 billion shillings by the close of the next fiscal year in June 2024. These revenue gaps have led to increasingly tough budget decisions, forcing the administration to prioritize expenditure rationalization and focus on viable financial reforms.

As a key strategy to address the shortfall, the PBO called for more efficient tax enforcement rather than new tax laws that might overburden Kenyans without necessarily guaranteeing compliance. The report advised the government to leverage existing tax frameworks and strengthen enforcement mechanisms, suggesting that such measures could be more effective in generating revenue than the addition of new tax policies.

Beyond tax reforms, the budget office urged the Ruto administration to enforce strict measures to curb unnecessary spending. This included reducing non-essential expenditures, implementing an e-procurement system to boost transparency, and prioritizing economically viable projects that could attract public-private partnerships. The PBO’s stance reflects a broader fiscal concern that Kenya’s economy, strained by the financial gaps of recent years, could face even greater challenges if fiscal policy is not managed prudently.

The Treasury, meanwhile, has tabled multiple proposals—some of which echo the previously rejected Finance Bill—that are under review for possible re-introduction. However, the PBO cautioned that each proposal must be carefully assessed for potential unintended impacts on the economy and the populace. According to the report, balancing the need for revenue with the citizens’ welfare should remain central to any future financial reforms.

This latest report from the PBO, known for its role in shaping the nation’s budgetary framework, underscores the need for a thoughtful, well-rounded approach to economic policy. By focusing on tightening existing tax structures and optimizing resource allocation, the Ruto administration may find a way to navigate Kenya’s economic challenges without resorting to new taxes—a move that could resonate positively with a population already feeling the financial strain.

LEAVE A COMMENT

You must be logged in to post a comment.