|

LISTEN TO THIS THE AFRICANA VOICE ARTICLE NOW

Getting your Trinity Audio player ready...

|

JPMorgan Chase’s CEO, Jamie Dimon, is set to embark on a significant trip to Africa in mid-October, marking his first visit to the continent in seven years.

The journey is seen as part of the U.S. banking giant’s broader strategy to expand its presence in Africa, a continent that is increasingly attracting interest from international financial institutions. Sources familiar with the plans have indicated that Dimon is expected to visit Kenya, Nigeria, South Africa, and Ivory Coast during this trip.

The bank, which already operates offices in South Africa and Nigeria, currently offers a range of services on the continent, including asset and wealth management, as well as commercial and investment banking. Despite these existing operations, JPMorgan has long had its sights on further expansion. In 2018, Dimon expressed interest in entering other markets such as Ghana and Kenya. However, regulatory challenges had previously hindered these efforts. For instance, local authorities in Kenya and Ghana had reportedly blocked JPMorgan’s plans for growth in those countries.

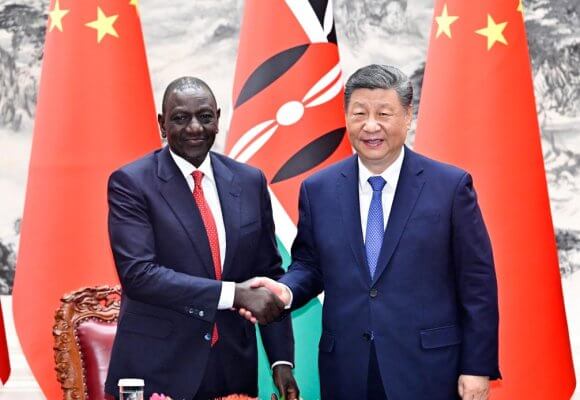

In a notable development, Kenyan President William Ruto announced in February 2023 that, following discussions with senior JPMorgan executives, the bank had committed to opening a new office in Nairobi. Although details remain unclear on the exact timeline for establishing this presence, the move aligns with the bank’s ambition to deepen its footprint in Africa’s fast-growing economies.

JPMorgan’s push into Africa is part of a broader trend among global financial institutions seeking to tap into the continent’s growing market for sovereign debt and corporate transactions. Analysts have noted that international banks are increasingly interested in serving multinational companies operating across Africa, as well as offering wealth management services to high-net-worth individuals.

Private banking is emerging as a critical area for global lenders. While many African consumers already have access to financial services through local and regional banks, private banking is seen as the next frontier in the continent’s financial evolution.

JPMorgan, one of the world’s top five international private banks by assets, has made it clear that growing its presence in overseas markets is a priority. The bank, which boasts over $4.1 trillion in assets and operates in more than 100 countries, has been aggressive in its global expansion efforts. Over the past five years, approximately 700 JPMorgan bankers have been involved in opening 27 new locations worldwide, generating $2 billion in revenue for its commercial and investment banking division.

The bank’s global advisory board, which includes high-profile figures with ties to Africa, such as Nigerian billionaire Aliko Dangote and former British Prime Minister Tony Blair, further underscores its focus on the continent. Blair, through his Africa Governance Initiative, has been involved in advising governments and promoting sustainable development across Africa.

LEAVE A COMMENT

You must be logged in to post a comment.